Are Company Holiday Parties Tax Deductible In 2025. Learn qualifying expenses and how to optimize deductions. There is no deduction available if.

Holiday parties are fully deductible (and excludible from recipients’ income) so long as they’re primarily for the benefit of employees who aren’t highly compensated. If you hosted a company party or two over the holidays, there’s good news:

The deductibility of costs incurred for company events, such as a christmas party, is covered under tax code sections 274 (e) (1) and (e) (4), which the tax cuts.

Any amounts paid or incurred after january 1, 2018 are 100% tax deductible if they were relating to holiday or company parties.

The Employer's Guide to Deducting Company Holiday Party Expenses, Or is your business throwing a holiday party? The good news is that holiday parties for employees generally are fully deductible for employers, with no tax implications for employees.

Are Company Christmas Parties Tax Deductible? Taxcare Accountant, First of all, the party has to be a business. Company socials, including anniversaries, holiday parties, and picnics, are still fully deductible.

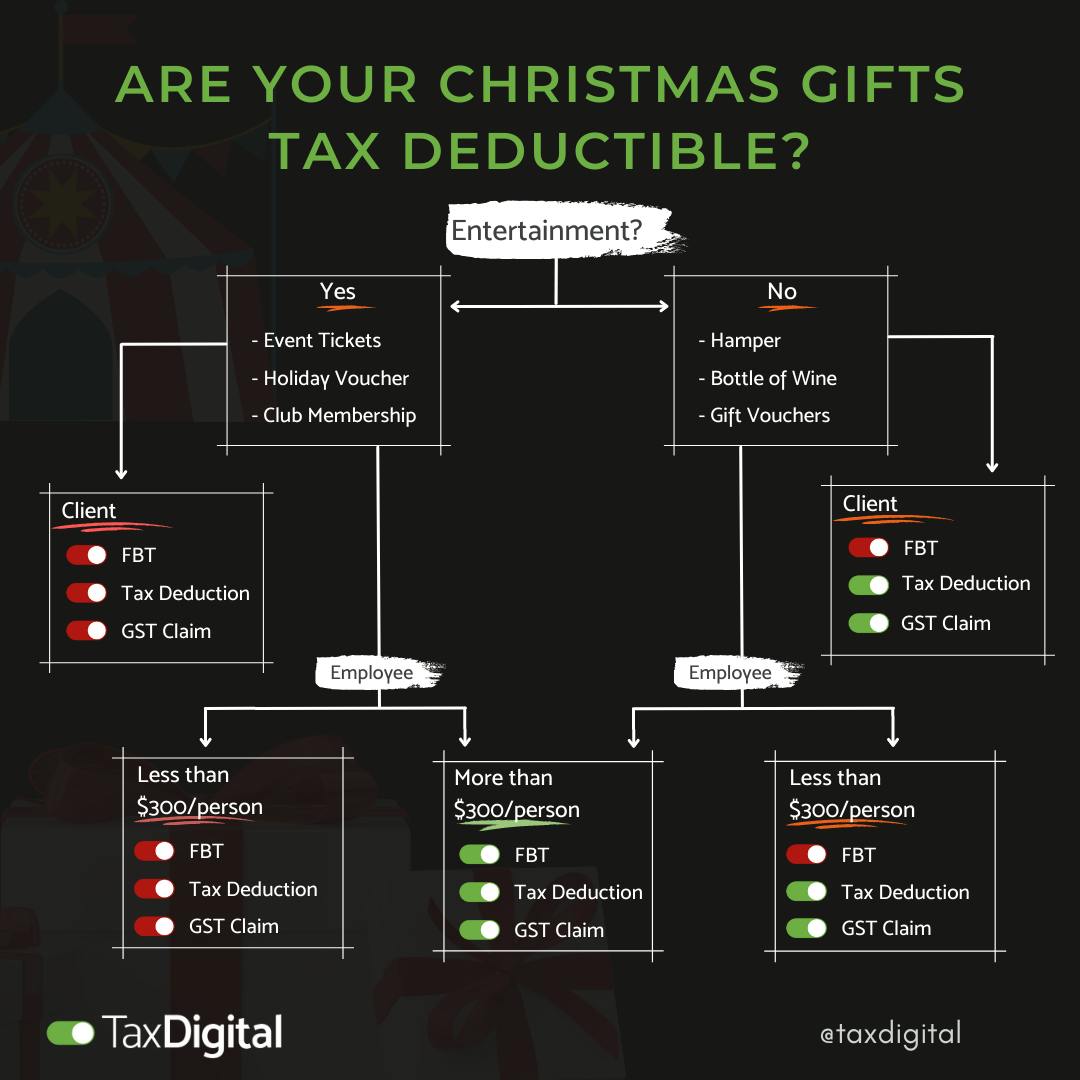

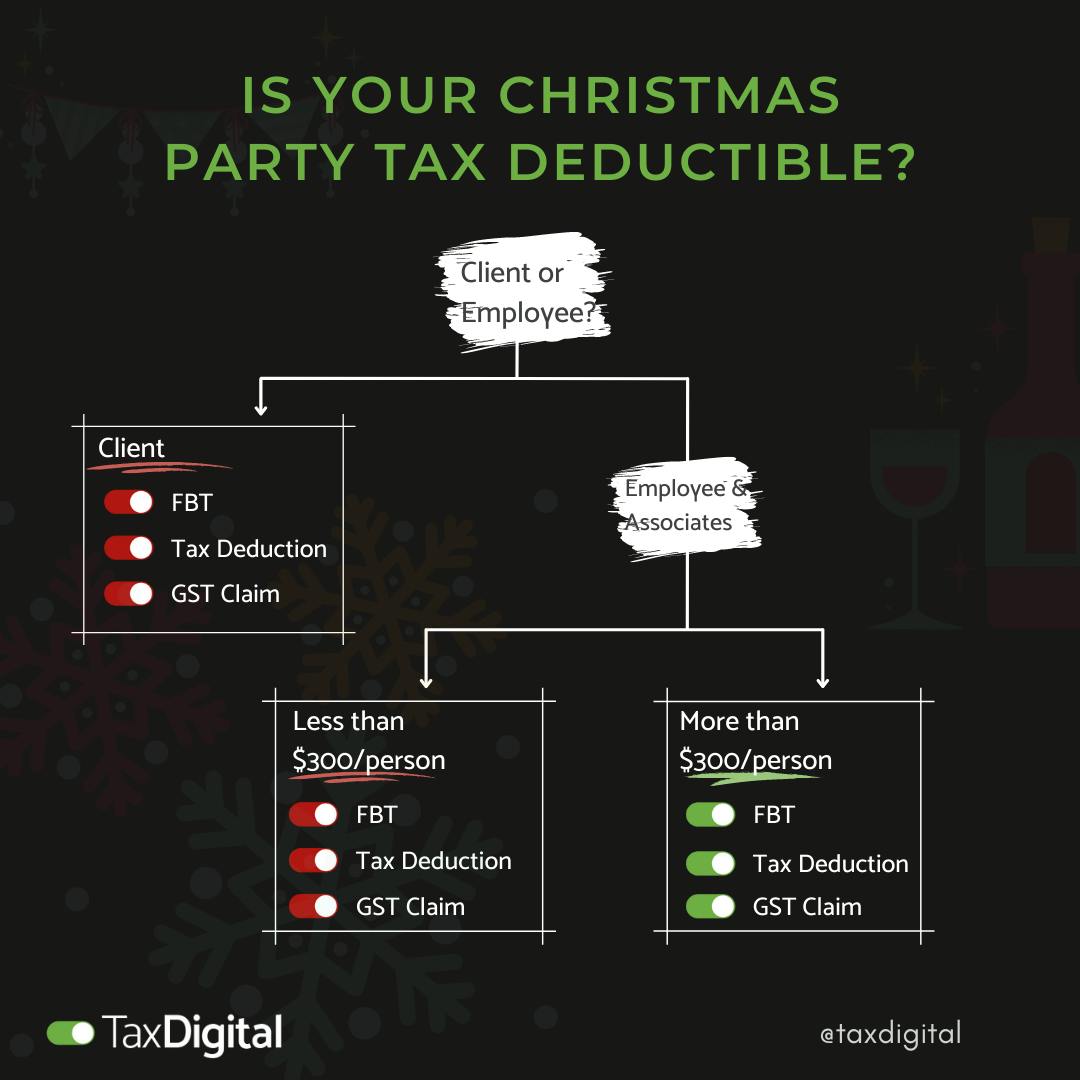

Tax Deductible? Christmas Parties and Gifts Tax Digital, The good news is that holiday parties for employees generally are fully deductible for employers, with no tax implications for employees. Choose noncash gifts for your team, in order to avoid tax complications.

Tax Deductible? Christmas Parties and Gifts Tax Digital, Discover what's deductible, whether for employees, clients, or key personnel. Holiday parties are fully deductible (and excludible from recipients’ income) so long as they’re primarily for the benefit of employees who aren’t highly compensated.

Christmas Gifts & Company Christmas Party Tax Deductible?, Discover what's deductible, whether for employees, clients, or key personnel. Choose noncash gifts for your team, in order to avoid tax complications.

Benefits for Employees Through Holiday Parties Are Holiday Party, Staff parties can be 100% deductible, if they’re fully inclusive and below the cra cost cap. Therefore, employers must look for other ways to.

Are Your Holiday Parties Tax Deductible? Intuit TurboTax Blog, If you hosted a company party or two over the holidays, there’s good news: Whether you are part of a large company or a small business owner with a few employees, holiday parties have been a way to celebrate successes and bring in the.

The Employer's Guide to Deducting Company Holiday Party Expenses, For 2025 and 2025, the covid. The good news is that holiday parties for employees generally are fully deductible for employers, with no tax implications for employees.

Are Christmas Party Expenses Tax Deductible? Financial Freedom, In most cases, holiday parties are fully deductible by the business and excludible from the recipients’ income. Therefore, employers must look for other ways to.

Are Christmas Party Expenses Tax Deductible? ExpenseIn Blog, This is as long as the event is held. While most business meals are subject to the 50% deduction rule, there are some exceptions that allow for a 100% deduction.